First published on LinkedIn on 17 January 2020

Africa’s power grid is struggling to meet surging demand

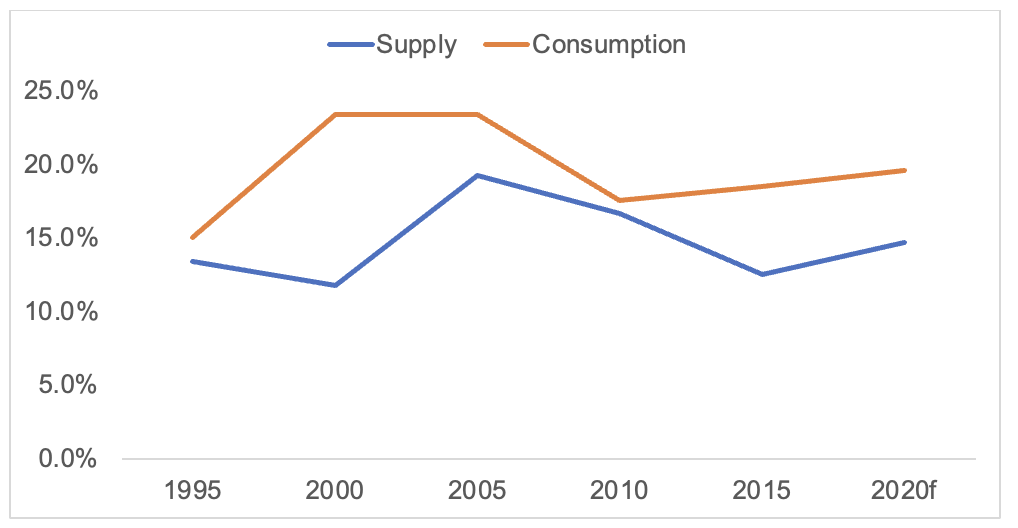

Africa is facing a power crunch. Demand for power from the continent’s rapidly growing and urbanising population far outstrips supply. According to estimates by the IEA, Africa’s demand for electricity has outgrown supply every year since 1990 (Chart 1), with consumption growing at 8.4% per year compared with 6.1% per year for power supply. This has created a widening power deficit which Africa’s power providers are struggling to close. The situation is exacerbated by Africa’s rapid population growth rate – one of the highest on the planet – which adds 30 million people every year. As a result, not only is grid power inadequate for those that are connected to it, but over half of African households have no grid connectivity at all and this proportion has remained largely unchanged for the last decade.

Even in densely populated cities power connections are poor and the grid is unreliable. The situation is so severe in Lagos that many households have not one but two generators: a main generator for the household and a second back-up generator for essential services (e.g. water pumps and refrigeration) in case the first one breaks down. So prevalent has the use of diesel-powered generation become that it is estimated that off-grid power provides more than four times the level of power actually delivered by Nigeria’s national grid.

Chart 1: % growth in Africa’s supply & consumption of electricity, 1990-2020

Sources: IEA, Kleos Advisory.

It’s expensive to be off-grid

The World Bank estimates that over 600 million Africans have no access to electricity. Given the high cost of extending transmission lines into remote areas, the relatively low income of off-grid consumers and the difficulties that power companies have in collecting fees for the power they supply, many such connections are simply not profitable. This means many peripheral and rural communities are unlikely ever to be connected to the national grid. This not only prevents these households from using electric lights and domestic appliances, but it makes accessing the digital economy prohibitively expensive for them.

Take the cost of recharging a mobile phone. In Kenya this costs KES10 (10 US cents) for a two-hour recharge. For a typical Kenyan mobile phone this provides 7 Watt hours (Wh) of power for 10 US cents. In comparison, UK households get about 500 Wh of power for the same cost – or 70 times as much. Being poor is expensive, as the saying goes. And the high barrier to accessing reliable power makes it more difficult and expensive for off-grid communities to connect to the digital economy, both in their own country and internationally.

Solar has a low power share, but household usage is surging

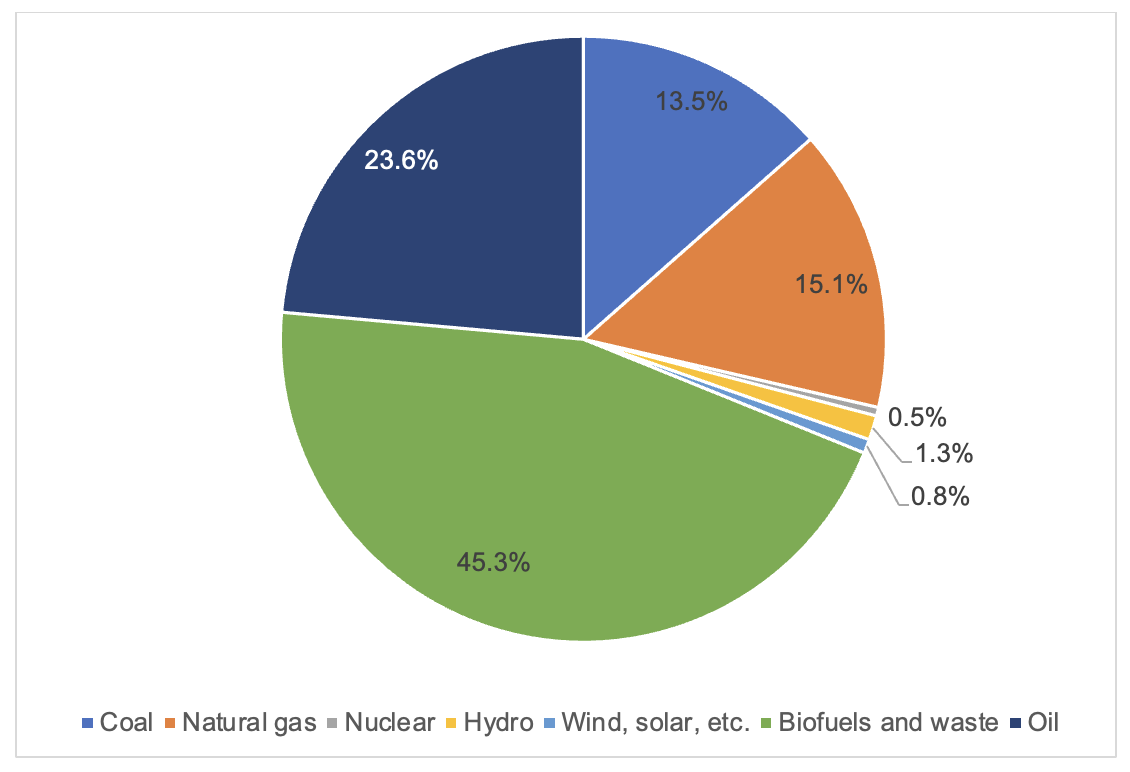

Given the inability of Africa’s power suppliers to provide a reliable grid, there is an urgent need for alternative sources of energy. Currently renewables make up only a tiny proportion of Africa’s overall grid-energy mix. Traditional sources of fuel dominate power generation. According to IEA estimates, hydrocarbons (oil, gas & coal) accounted for more than half of African energy production in 2017 (Chart 2), followed by biofuels & waste (45.3%). In contrast, solar & wind made up no more than 0.8% of total power supply.

Chart 2: % share as source of fuel for Africa’s power generation, 2017

Source: IEA.

But the power balance is changing. African solar power output grew twentyfold over the period 1990-2020, to an estimated 6,090 ktoe (kilotonnes of oil equivalent). Despite being a very young industry, Africa’s solar power sector already has a high degree of segmentation and diversification. Some companies are focused on large-scale production to replace grid power. Others are leveraging solar’s ability to connect African households to their own private power supply and to sell them an array of goods and services that are enabled by access to electricity. The growth in solar has been particularly strong in providing entry-level power to African households, with an estimated 5m pay-as-you-go (PayGo) solar home systems sold in the five years to 2019. [1]

It is therefore puzzling that the uptake of solar technology by African governments has until recently been, with a few exceptions, weak or piecemeal. For the most part the private sector has led the charge to test and develop solar technology in African markets and overcome the poor reputation that the first generation of solar tech gained in the late 1990s, notably in West Africa. Many of these first-generation solar units were poorly manufactured and difficult to maintain, and there was no customer support when problems arose. As a result, solar tech got a bad reputation. Since then many governments have focused on supporting (often failing) power utilities and distribution networks while those consumers who can afford diesel generators have relied on them to provide power. Only relatively recently has off-grid solar been more widely recognised as a key element in the overall energy mix.

Next generation solar, combined with fintech, could change the game

The next generation of solar tech could change the game. For a start, solar technology is far superior to the rudimentary units sold in the 1990s. Today’s solar units are more robust, efficient and automated. Some come with smart software that monitors the amount of power being received by the solar panels and moderates its flow to ensure there is a steady flow of power throughout the day and night. The latest solar units can be linked to numerous electronic devices and digital services, connecting their users to the digital economy. But the crucial breakthrough has been combining solar power with mobile credit and payments, giving every African household access to affordable off-grid power.

Pioneering next generation energy companies introduced this model around 2012 and the PayGo sector has grown into a significant part of the broader energy landscape. The PayGo model combines the latest solar technology with fintech to enable first-time African consumers to buy a solar unit on a rent-to-own basis. Repayments are made by mobile, with the daily cost equalling the typical expenditure on buying kerosene for lighting and paying to recharge mobile phones. In as little as 18 months users can own their solar unit outright, and in the process build their own credit history. This can be leveraged to purchase upgrades and electronic devices powered by the solar unit (e.g. widescreen TVs, set-top boxes and fans) and to give them access to financial services, including mobile banking and insurance.

The impact of solar-fintech models has been huge, allowing millions of Africans to make the digital leapfrog into the connected world. Not only have over 5 million PayGo sales occurred in Africa since 2015, but the uptake is accelerating, with more than 1 million sales in the first half of 2019 alone. [2] With each household comprising five members, this means that up to 25 million additional Africans are getting off-grid power under the PayGo model. That is larger than the population of Africa’s largest city, Lagos (around 21 million). And the vast majority of these solar units has been paid for entirely by the consumers themselves, without a penny of government or development money.

Of equal importance to solar’s transformational potential is the astonishing speed at which solar technology is stepping up to provide an experience that is like the grid. In 2010 a typical solar unit could replace a kerosene lamp for around three hours per day – hardly a replacement for grid power. Today an affordable solar unit can power a 32-inch television with satellite, 24 hours a day. In five years’ time affordable solar units are expected to be able to power all the key routine devices many Africans have in their homes, such as mobile phones, TVs, fans, lights and the Internet. For occasional high power use (washing machines or hair driers), users can always use a diesel generator. At that point, who cares whether you are on the grid, especially if that grid is expensive and unreliable?

The reality for many Africans in peripheral or remote communities is that they don’t need to be on the grid to get the benefit of energy. Most off-grid African households have limited power needs. A recent study by the Access to Energy Institute (A2EI) estimated that 97% of diesel generator usage for individual households in Nigeria was for lighting, fans and entertainment (TV and Internet). [3] All of these devices can currently be powered by solar.

The rise of “free power”

There is a further, unique dividend that solar-fintech models can deliver to African consumers, a benefit that not even consumers in Western markets receive: free power. Once PayGo customers have paid off their units they own them outright and the power they receive is free. Given that current solar batteries have an operational life of 12 years, this gives each household at least ten years of free power, sufficient for a range of standard domestic devices. Periodic upgrades and improving solar technology will likely increase battery life further, extending the provision of free power.

Azuri Technologies estimates that out of Africa’s 5 million PayGo customers around 2 million have fully paid off their units. This means that 10 million Africans are receiving free electricity in their homes. The growth of reliable free power has the potential to enable millions of Africans who are currently off grid to get access to basic power and play a full role in the digital economy. With the number of PayGo energy customers expected to double by the end of 2020, driven by strong demand for affordable power and the increasing efficiency and capabilities of solar tech, the trend towards off-grid power will continue to accelerate.

Off-grid solar represents a $24 billion per year opportunity in Africa

Given the ability of solar-fintech solutions to deliver power to African households along with the affordable financing to pay for it, solar could be the breakthrough technology that finally connects Africa’s vast off-grid communities. Every country needs a diverse energy mix and off-grid solar should play a key role alongside the grid and generators in ensuring that all African households are connected.

With over 600 million Africans still without access to electricity, the commercial opportunity to deploy solar-fintech is enormous. Given an average of five people per African household, there are currently 120 million homes without power. With each household spending an average of USD 200 per year on power, this represents a commercial opportunity of USD 24 billion per year. This figure represents just the displacement of fossil fuel spending and does not factor in the additional goods and services that can be sold to new consumers over the solar-fintech platform.

The UK – which is reconsidering its future trading relationships and its position as a global financial centre – is ideally positioned to benefit from this opportunity. British companies have been pioneers in Africa’s PayGo solar sector and they are rapidly expanding their African footprint and customer base. In the process they are creating the next generation of African consumers ‘out of thin air’, all of whom will need innovative financial and insurance products, while deploying a technology that is financially inclusive and green.

The combination of solar and fintech is driving an economic transformation in Africa, making the ‘unbankable’ bankable and embedding African consumers in the digital economy. This technology’s many applications will be explored further in this series.

References

[1] Source: Azuri Technologies.

[2] Azuri Technologies estimates.

[3] Source: Access to Energy Institute (A2EI).