First published in GTR on 14 January 2020

Côte d’Ivoire produces around 45% of the world’s cocoa (an estimated 2.2 million tonnes in 2018/19) and the value chains that manage the cocoa flows are highly complex. There are numerous players, from the local buyers (known as pisteurs) to the grinders, trading houses and offtakers. But within these value chains the country’s 600,000 cocoa farmers are essentially invisible. Cocoa appears miraculously at the start of the chain – delivered to a field warehouse or grinder with little indication of where it was produced or by whom. At least three quarters of Ivorian cocoa production is not traced back to its source, with most being sold in bulk shipments to offtakers by local aggregators (intermediares).

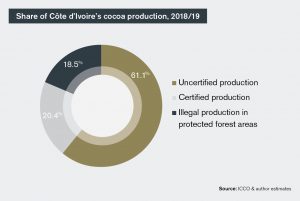

The inability to link the cocoa to the farmer raises huge questions about the sustainability of the cocoa sector. When we buy a bar of chocolate, how do we know for certain that the cocoa in it was not produced with child labour or environmental damage? This is a major issue in Côte d’Ivoire where an estimated 500,000 tonnes of cocoa (18.5% of national production) is being produced illegally in protected forest areas, causing devastation to the local ecosystem. But farmers’ invisibility in the value chain also has indirect impacts, denying farmers access to lending, insurance and training. For commercial banks, who have no information about the cocoa farmers, their farms or cocoa earnings, most farmers are effectively unbankable. And the little financing they do receive is drip fed to them by the cooperatives or by microfinance institutions.

The key to overcoming these challenges is better use of data. A common complaint made of Africa is that there is no data; but this is simply untrue. Côte d’Ivoire’s hundreds of cocoa cooperatives have a wealth of data on their members, their farms, dependents and cocoa deliveries; some even track the use of inputs, crop protection and attendance at training. Many have completed detailed GPS mapping of all their farms (often using mobile apps) and every cooperative uses a system, however rudimentary, for tracking farmers’ beans after delivery. In addition, government agencies and revenue authorities have a rich pool of data on cocoa purchases, exports and flows.

The problem is that all of this data is disaggregated, whether stored in spreadsheets, on laptops or on paper ledgers. Moreover, there is little sharing of data between the key players in the cocoa value chain, even when it is in the interest of both parties to do so, and there is little analysis of the rich data flows that are being produced. But this situation is changing, led by the trading houses, offtakers and certification labels.

The key offtakers of Côte d’Ivoire’s cocoa – Cargill, Olam, Barry Callebaut – have long used sophisticated systems for tracking cocoa through their value chains. Their organisations are typically horizontal, with data flowing smoothly from one end to the other: if there is a problem at the start of the chain, all stakeholders further down the chain are immediately informed so that they can make adjustments to smooth out any disruption. But offtakers’ data on the farmers they buy their cocoa from has historically been poor. However, under pressure from their certification partners, tightening international regulations and rising consumer demand for ethically and sustainably produced chocolate, the offtakers have stepped up their game.

In recent years they have developed systems that can trace beans back to the cooperatives who produced them. These systems include Cargill’s Farmforce, the Olam Farmer Information System (OFIS) and Ocean’s Cocoa Source.1Specialised offtakers who buy small volumes use their own tracking systems, for example Tony’s Chocolonely whose Bean Tracker can trace a single chocolate bar back to each lot of cocoa purchased and hence the group of farmers who produced it.2 The leading certification labels, Fairtrade and Rainforest Alliance/Utz, have their own tracking and audit systems that are used by certified cooperatives and their farmers. As a result of these efforts, around 25% of Ivorian production is now certified, either by the certification labels or under offtakers’ parallel sustainability and traceability programmes.

New tech solutions

Now a new generation of tech that links together devices on the ground to data in the cloud – the so-called Internet of Things (IoT) – is taking traceability to a new level, making it possible to digitally connect the farmer to the value chain. The key facilitators in this process are the delegates (délégués): members of the cooperative who live among the farming community and who act as a bridge between the two. Délégués are the backbone of the cooperative structure, onboarding new members, collecting their cocoa either in person or at small field warehouses (magasins), delivering it to the cooperative and making sure farmers are paid for it.

In recognition of their critical role, Cargill has contracted a Kenyan fintech, Capture Solutions, to digitalise the délégués.3 The system was first trialled in Kenya, tracking tea from 70,000 farmers through the value chain, and is now used by Unilever for all its tea operations in Africa. Each délégué is issued with a personal digital assistant (PDA) that is preloaded with software and is trained in its use. The PDA connects with several other pieces of tech: digital weighing scales; tags with unique bar codes and serial numbers; and a biometric fingerprint sensor.

When the farmer arrives at the field warehouse to deliver his cocoa, he first scans his fingerprint. This identifies the farmer (there is no need for ID cards) and lets the délégué see all relevant information on his PDA, from the farm size and typical deliveries to the farmer’s payment history. Next, each bag of cocoa is weighed on the digital scale, which prints out a receipt for the farmer and automatically transmits the data to the PDA. The délégué then scans a unique tag with his PDA and attaches it to the bag. When the délégué delivers batches of cocoa to the cooperative, each bag is scanned into the system, directly linking it back to the farmer, who can then be paid digitally as soon as the bean quality check is complete. Once the beans are sent to Cargill, each bag can be traced from the end of the value chain back to the farmers who produced it.

But making farmers visible in the value chain is not just about data collection. The real value comes from analysing the data about them. Currently most cooperatives produce a wealth of data on their farmers and cocoa flows, but the data is disaggregated, is rarely shared between teams and is barely analysed. Moreover, the data management systems used by cooperatives for their offtakers are proprietary, giving them no ownership of the data in them, and little useful information is fed back from the offtakers to the cooperatives.

In order to address this problem a new generation of data management platform is being developed that enables cooperatives to directly manage their data flows and extract more value out of them. Two leaders in this space are the British software developer PCR and the Ivorian software developer, Direct Soft.4 These companies’ platforms – the Caja Data Platform (CDP) and Agrix, respectively – incorporate all data flows into a single management system that lets cooperatives visualise the data in a way that is useful.5

PCR is working with the Farmstrong Foundation and its 34 farmer groups in Côte d’Ivoire, while Direct Soft is working with the 29 cooperatives that sit under the umbrella of Ecookim.6Each system has over 20,000 farmers registered on it and boasts comprehensive data about the farmers, their dependents, farms, use of inputs and crop protection, as well as their typical cycle of cocoa deliveries and detailed payment and borrowing histories(see text box). This data can be fed directly into the systems used by the cooperatives’ certifiers and offtakers, automating most of the data collection process.

But it is these systems’ ability to analyse the complex data flowing through them and extract valuable insights from it that make them transformational. For example, accurate GPS mapping of farms enables cooperatives to prove their members are not producing cocoa in protected forest areas, and this data can be leveraged to create heat maps of yields across an entire region, pinpointing the best and worst performing areas. This not only enables cooperatives to know where to focus remedial action, but it can also be used to stamp out fraud: if one farm has a yield significantly higher than the farms surrounding it, it could indicate that the farmer is mixing non-certified beans with his own production.

By the same token, detailed data on the farmer’s children and dependents can be leveraged to help stamp out child labour. If the system knows where the farm is, the school ages of the children and the schools they are registered in, it can automatically alert the cooperative if there is a high probability that the children are not attending school (for example, if the nearest school is more than a few miles away). Capture Solutions is going one step further with a pilot it is running with UNICEF at several secondary schools in Agboville: each school is issued with a biometric fingerprint sensor which is used to monitor school attendance, closing a potential loophole in the certification process where children are registered at a school but are not actually attending classes.

But arguably the greatest benefit that effective data management can bring is unlocking finance for farmers. Currently commercial banks do not lend directly to farmers: without accurate KYC data, performance or credit history, most farmers are unbankable. But all of this data exists in the cooperatives’ data banks. When properly managed this data can be fed selectively to the cooperatives’ banking partners, greatly easing the onboarding process for new accounts. Several banks and microfinance institutions are developing banking services for cocoa farming communities based on this data. This is paving the way for banks to offer direct lending to farmers in the future, taking pressure off the cooperatives who currently provide the bulk of financing to their members.

The effective management of data has the potential to transform the outlook for cocoa farmers in Côte d’Ivoire. Once they become visible in the value chain and their cocoa can be tracked from delivery the whole way through the chain to the final offtaker, these cocoa farmers will become a part of that value chain. And as members of that value chain they will be able to benefit from the support that all trading houses and offtakers give to their suppliers (currently grinders and traders), from direct financing, to health, life and crop insurance.

Key data captured by data management platforms Caja Data Platform (CDP) and Agrix

References