Led by smartphone technology and solar power, tech will help lead Africa out of the COVID-19 crisis, and as it does it will embed itself in the way Africans live, work and transact

First published on this website on 22 June 2020

Photo source: SciencesPo.

Digital innovation and fintech were always going to play a leading role in Africa’s development. Just look at the impact that the growth of mobile phones and mobile money have had on the continent over the past 20 years. But as COVID-19 paralyses economies across the continent, tech is being called on to fill the gaping holes caused by lockdowns and social distancing. This is dramatically accelerating the speed of digital adoption and in the process is pushing Africa past the tipping point towards a fully-digitalised economy.

The surge in mobile banking has boosted digital inclusion

The driver of digitalisation in Africa has been the mobile phone. Back in 2000 barely 1% of Africans owned a mobile phone, coverage was primarily in the cities and only the rich could afford handsets. Today almost half of Africans own a mobile phone and in cities ownership is typically 100%, or even higher as many Africans have multiple SIM cards. And the quality and affordability of the handsets is improving at an exponential rate. Simple handsets cost as little as USD 10 and the latest generation of ‘smarter’ feature phones – without touch screens but with 3G – can be bought for USD 30.

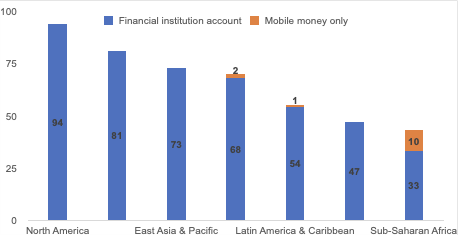

Chart 1: Adults with financial institution account and mobile money only, 2017

Source: Global Findex (2017), World Bank.

The breakneck growth in mobile adoption has laid the tracks for the roll-out of mobile banking. According to the World Bank’s Global Financial Index (Findex), only one third of Africans have access to formal banking services, the lowest rate for any region in the world. However, a full 10% of Africans have access to mobile banking – whether via a banking app or a mobile wallet with their telco provider – the highest rate on the planet. And nearly all of the increase in financial inclusion in the past decade has come from mobile banking. For the most digitally advanced economies, mobile and financial inclusion is almost universal. Take Kenya, home of Safaricom and M-PESA, where 96% of the population own a mobile phone and 73% have a mobile money account.

One of the reasons fintech has been so rapidly adopted in Africa is because there is no alternative. Most Africans can’t go to a bank as outside the cities branches are few and far between. Even those in reach of a bank struggle to open an account; with poor documentation, no collateral and no credit history, most Africans are effectively ‘unbankable’. But mobile banking has transformed this picture, giving millions of Africans with mobile phones access to payments, lending, savings and insurance.

By using mobile phones African consumers can overcome registration and KYC blockages (for example, by using data from their SIM cards & phone’s GPS) and they can leverage their digital payment history to access micro-loans and micro-insurance. For lenders a mobile solution greatly reduces the cost of monitoring loans and collecting tiny repayments, and it can cheaply spread the risk among a large pool of micro-borrowers.

The rapid adoption of fintech has opened up a new world of remote services for ordinary Africans, without the need for person-to-person contact. Mobile payments are quicker and cheaper than trying to send cash to someone and for many urban consumers digital payments have replaced cash for most transactions. Even in rural areas where mobile banking is less widespread owing to poorer network coverage, digital remittances have surged, helping alleviate shortages of cash on the ground.

But most business is still transacted face-to-face

But even as digital payments are growing, most business is still done face-to-face. African society is built around human interaction, through daily contact with family, friends, neighbours and customers. The continent’s vast agricultural value chains involve millions of Africans, many of them migrants from neighbouring countries, through whose hands (literally) the goods and commodities flow. And in the towns and cities informal traders form the bedrock of the economy: from the one-woman street kitchens on every street corner to the hawkers plying their goods between the cars stuck in traffic jams.

A large proportion of households in Africa are, in effect, SMEs, each running their own micro-business. Together Africa’s SMEs account for over half of the economy and provide more than 80% of employment. But all of this economic activity is transacted in close proximity with others – often crushingly so, as anyone who has ever visited an African market can attest. And the COVID-19 pandemic has thrown this entire way of living on its head.

By forcing African governments to severely restrict or ban person-to-person contact, the pandemic is choking off the roots of the economy. Unable to travel to work or mingle with people, every informal worker faces losing their livelihood overnight. For these millions of cleaning ladies, taxi drivers, construction workers and market sellers, working from home is not an option. Even if restrictions are lighter, how can you maintain a safe social distance on a crowded bus or in a heaving market? These workers have no safety net and, unlike in other developing markets like India, few Africans have savings. Instead they must rely on a constant flow of income, often small, to fund day-by-day purchases of food and essentials.

The impact will be severest on the poorest households for which an enforced lockdown in homes without power, access to clean water or sanitation is an ordeal. Even cash is now suspect, as infected banknotes can be vectors of the virus. Recognising this the Bank of China is collecting and destroying all bank notes collected by hospitals, wet markets and buses in affected areas in order to prevent the spread of the virus.

The pandemic is accelerating the digital shift in Africa

The jolting impact of COVID-19 is forcing African governments and their citizens adapt to a new way of living and transacting business remotely. In uncertain times people innovate and the crisis is accelerating the digital shift. Many African countries have been forced to shut schools, buts some are rolling out remote learning, for example in Kenya where there is a dedicated free TV channel – Edu TV Channel 029 – with daily lessons in English, Kiswahili, maths, science and hygiene.

Telcos are also making access to digital services cheaper. For example, Safaricom has introduced a fee waiver for transactions under KES 1,000 (USD 10) on its M-PESA payment platform. As this network handles over 90% of the country’s mobile payments, this has in effect introduced universal free banking. Safaricom has also launched a service – Lipa Mdongo Mdongo – that enables customers to buy smartphones for as little as 20 US cents per day, with no down payment. And there are numerous public information campaigns, notably the #DontGoViral campaign launched by UNESCO and i4Policy to combat the spread of misinformation during the epidemic. [1]

The key to supporting this digital shift is affordable tech. Radio is everywhere and to use M-PESA you only need a mobile phone and a network connection. Beyond this, TVs and smartphones can provide a platform to leapfrog to the next level of digital services, including EdTech and mHealth. But for all of these services you need power, relatively expensive devices such as TVs, and connectivity. Which means for the 600 million Africans (roughly half the population) who live in off-grid communities with no access to electricity, these digital options are not available.

Solar-fintech is an essential tool for supporting this shift

One solution to breaking this logjam is the Pay-as-You-Go (PayGo) model for distributed power and appliance purchase. This combines the next generation of solar powered units with a fintech payment solution, enabling first-time African consumers to buy a solar unit and appliances powered by it, such as a 32” TV with satellite service, on a rent-to-own basis. Repayments are made by mobile and in typically 12-30 months users own their solar unit outright, receiving free electricity thereafter. In the process householders also build their credit history which can be leveraged for consumer credit and micro-insurance.

Solar power has seen massive growth over the past decade, with an estimated 180 million units sold worldwide since 2010. [2] In Africa, PayGo solar home systems provide entry-level power to over 25 million Africans. These solar units power most devices in a typical household – such as mobiles, lights, TVs and fans – and can also support everyone working in those households. The ability to recharge a mobile phone is essential for any SME, particularly when using a smartphone that may need to be charged twice a day for heavy use. [3] The PayGo model is well suited to households that live day to day and have no savings. In stark contrast to Western markets where consumers usually purchase assets outright, the PayGo model turns the cost of both the solar unit and the appliances (TV, fan, fridge, etc) into a daily expense that can be budgeted for, replacing existing expenditure on kerosene and recharging mobile phones.

In the context of COVID-19, the ability of PayGo solar to connect Africa’s off-grid communities is giving a further boost to growth. Just as home working has driven video conferencing in developed nations, so the increased time at home is driving demand for household lighting and TV at home, as well as the need to recharge smartphones to run SME businesses. It is likely that, as is happening with video conferencing, this will drive a permanent change in how Africans live their lives and there will be no return to “business as usual” once the COVID pandemic has abated.

Azuri Technology distributing solar home kits in Kenya, June 2020

There is no turning back

With the pandemic still spreading in Africa it is too early to say how it will impact each country and region. But however Africa manages its way through this crisis, it will be played out against a backdrop of acutely depressed global demand, disrupted supply chains and a collapse in education. Whether the global recovery will be V-shaped, L-shaped or like the tick on a Nike trainer (rapid decline, slow recovery), the difficult economic environment is certain to continue for some time, putting huge strain on African economies.

In the short term the focus will be on alleviating the immediate impact on households and businesses, with measures including e-vouchers for food and household essentials, cheaper or free mobile payments and low-cost micro-insurance.

During the recovery phase tech will play a leading role in rebuilding the economy, the health services and the education system. E-commerce, EdTech and mHealth were already growing rapidly in Africa before the outbreak and they are proving their worth in the crisis, enabling traders to buy and sell goods over WhatsApp, helping students study for exams online and giving those living in peripheral communities access to remote health consultations. [4] Post-COVID the drivers of the new economy will be the TV, the mobile phone and the Internet which are by far the fastest ways of delivering essential services.

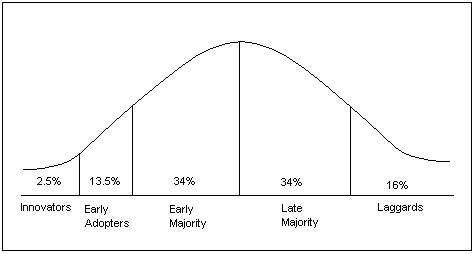

Chart 2: Diffusion of Innovations Curve

Source: Everett Rogers, 1962.

But digitalisation is not a short-term fix to get through the crisis. It is a process that will push Africa beyond the digital tipping point, rapidly onboarding the so-called ‘Late Majority’ and dragging in the ‘Laggards’, whether they like it or not (Chart 2). Prior to COVID-19, GSMA forecast that half of Africans would own a mobile phone by 2025. [5] Given the digital acceleration currently under way, this figure will be reached in the next eighteen months, adding a further 200m-300m Africans to the digital economy in a single step. By then over half of Africans will have a smartphone and a 3G signal, opening up every kind of service that can be delivered digitally. And digital payments – which made up just 10% of all payments in Africa before the pandemic – will surge to levels seen in markets like Kenya where over 40% of the population regularly pay by mobile.

At that point, there will be no turning back. Because once a more efficient and easy-to-use way of doing business is adopted it becomes embedded, causing a structural shift in behaviour: just look at the shift to e-retail in Western and Chinese markets. Over a short period digital payments, e-commerce and remote learning will become the norm in Africa – not the reserve of a privileged elite – and by removing numerous market barriers they will unleash the entrepreneurial potential of millions of African SMEs.

The digital revolution has long been gathering pace in Africa. Turbo-charged by COVID-19 it will sweep all before it, embedding fully-digitalised economies across the continent.

References

[2] Report by the World Bank & the Global Off-Grid Lighting Association (GOGLA), March 2020.

[3] See Azuri Technologies website for case studies of customers whose businesses have been transformed by their ability to recharge their mobile phones at home (https://www.azuri-group.com/impact/#stories).

[4] For example, Kenya’s PEEK eye-scanner (using a mobile phone camera) tests for eye diseases while Cameroon’s Cardiopad tests for heart problems. Both can be operated with a minimum of training and the data sent for immediate remote diagnosis.